While many seniors are starting to hear if they’ve been waitlisted, deferred, or accepted, they’re met with an inevitable reality: college is closer than ever.

This season of change can feel scary, as it is unknown territory, but senior counselor Whitney Singleton is here to help.

“I really love working with this class,” said Singleton. “I’m excited to see where you all go.”

Throughout this series, Mrs. Singleton will share important information about financial aid, scholarships, and acceptance letters, in addition to her email series “Things You Should Know.”

Most recently, on December 1st, FAFSA, also known as the Free Application for Student Aid, opened.

“It is not hard to do,” said Singleton. “It links up with the IRS where people file their taxes, so it’ll automatically pull that information.”

While FAFSA isn’t a scholarship itself, it is a government based program that acts as a nexus for students looking for ways to fund their education.

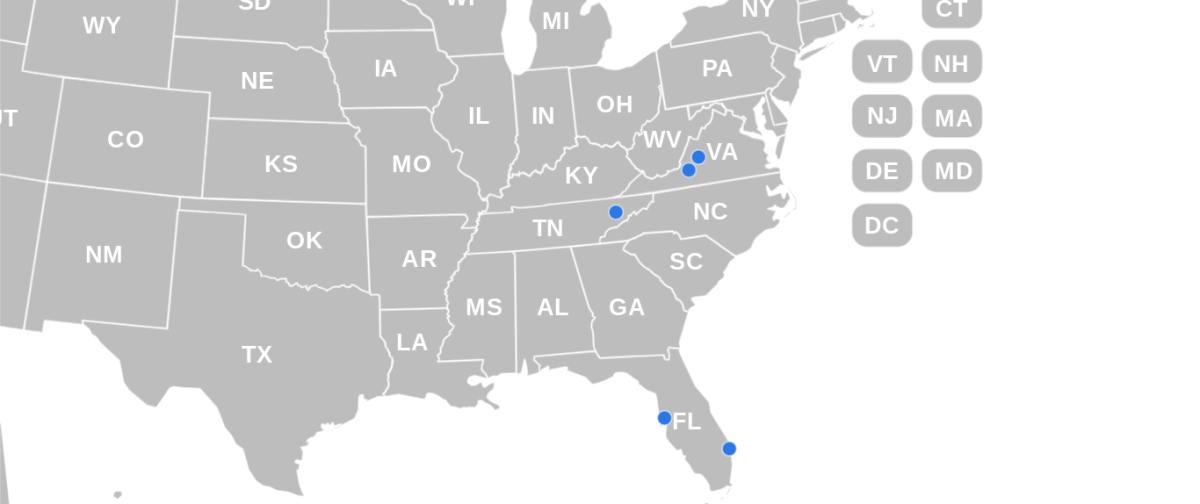

“FAFSA is the only way that you are able to get things like TN Promise, [the] Hope Scholarship, and [the] Pell Grant,” said NiswongerCare advisor Peyton Vance.

Even though most scholarships are merit based, FAFSA awards money on a need-basis. The maximum amount awarded by the Pell Grant is $7,395.

However, the amount of money a student is eligible to receive is based on several other factors like GPA, extracurriculars, ACT score, and athletics. It’s renewable too, and seniors should be aware that it is important to fill it out each year of college.

“I’m here if anybody needs anything,” said Singleton. “My door is always open.”

If students or parents have any questions feel free to contact Mrs. Singleton at [email protected].

Categories:

News – Sessions with Singleton: Facts about FAFSA and how to get the best financial aid for your needs

It’s been college application season for awhile. But now, decisions are rolling in, and most likely, questions are being rased about how to apply for scholarships and financial aid.

December 19, 2024

Anna Grace Hodges

Counselor Whitney Singleton is available to help with the entire college enrollment process.

0

Donate to Maroon and White

$250

$500

Contributed

Our Goal

For over 100 years, the Maroon and White has been a trusted voice in journalism, shaping a better Tennessee High community—your support keeps this legacy alive and thriving for generations to come.

More to Discover